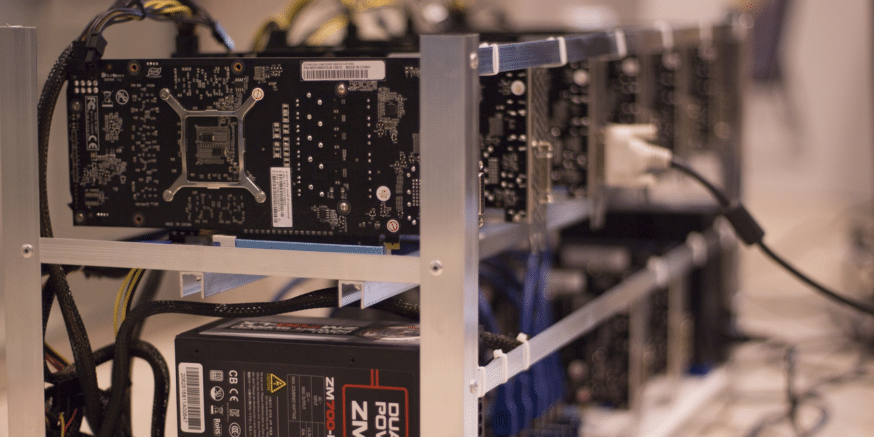

China is looking to ban cryptocurrency mining and regulators in the country are seeking public opinion on the matter. The nation is home to the world’s biggest mining-pools and hardware manufacturers.

Its leadership is, however, distrustful of cryptocurrencies and is currently considering a ban due to a melange of factors. According to the National Development and Reform Commission (NDRC), crypto mining is unsafe. The agency also says that it has the potential to cause substantial damage to the environment.

Authorities in the country are cracking down on illegal mining operations which have been on the rise since the recent cryptocurrency market boom.

Over a dozen suspects were recently arrested in China’s Jiangsu province. The electricity-theft syndicate was found to be running an extensive crypto mining operation with 4,000 miners. The local power company is said to have incurred losses running into tens of millions of Yuan due to the shady setup.

Authorities in China are also grappling with the construction of illegal crypto mining farms in Sichuan Province. Electricity tariffs in the region are usually among the lowest in the country during the rainy season. The area has over 25 operational hydroelectric dams which generate cheap power during this time.

Although illegal mining schemes are becoming a major headache for the authorities, the Chinese government also wants to ban cryptocurrency to stem large-scale capital flight.

The Sino–U.S. Trade War and the Attempt to Mitigate Capital Flight

The Chinese and U.S. governments are embroiled in a trade war that is threatening to undermine China’s economy and its national currency.

With major industries in recession and the economy at its most vulnerable, there are fears that an increase in cryptocurrency mining and trading could, at this juncture, trigger massive capital flight.

The saber-rattling has led to an economic slowdown in China. According to the International Monetary Fund (IMF), the country’s economic growth outlook for 2019 has cascaded to 6.2 percent from 6.6 percent last year. It is expected to contract to 6.0 percent in 2020.

The bleak economic situation is believed to be driving the adoption of popular decentralized digital currencies such as bitcoin which are perceived have better value-retention in the long term as compared to fiat currency.

More Chinese investors are also reportedly selling the Yuan for stablecoins. According to a recent revelation by XBTO CEO, Philippe Bekhazi, digital currencies are slowly becoming a new fad among the country’s entrepreneurs.

The Chinese government is already attempting to curb capital flight through monetary transfer policies and ramping up operations against black-market forex trading. Stablecoins are, as a result, emerging as a new way to shield funds from trade-war instigated economic turbulence.

(Featured Image Credit: Pixabay)

[thrive_leads id=’5219′]

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.